BTC Price Prediction: Analyzing the Path to $120,000 and Beyond

#BTC

- Technical indicators show BTC trading above key support levels with resistance at $116,579

- Institutional adoption and major investments ($6B from Capital Group) provide strong fundamental support

- Macroeconomic factors including potential Fed rate cuts and regulatory developments create favorable conditions

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Average

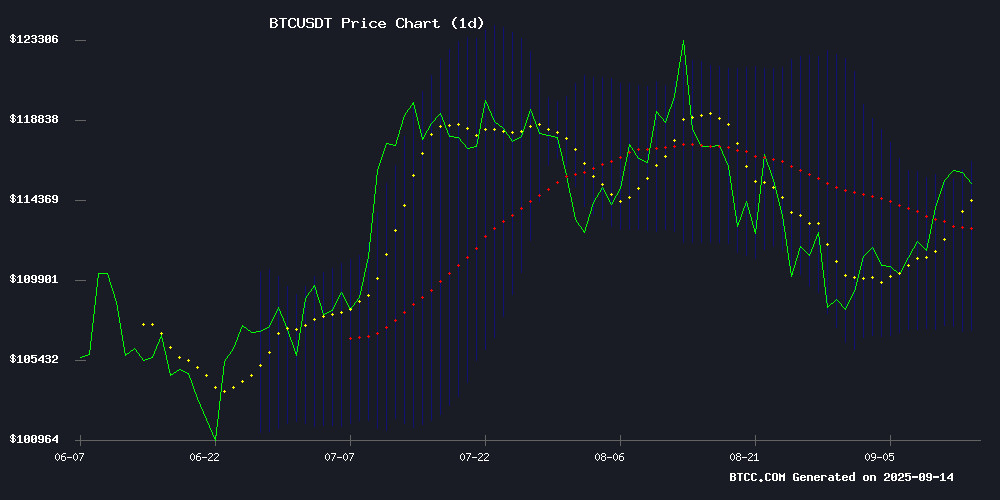

BTC is currently trading at $115,477.50, positioned above its 20-day moving average of $111,820.55, indicating underlying strength. The MACD reading of -1,687.16 suggests some near-term bearish momentum, though the price holding above the middle Bollinger Band at $111,820.55 shows resilience. The upper Bollinger Band at $116,579.12 presents immediate resistance, while support lies at $107,061.98. According to BTCC financial analyst Robert, 'Maintaining above the 20-day MA is crucial for continued upward movement toward the $120,000 psychological level.'

Market Sentiment: Institutional Confidence and Macro Tailwinds Support BTC

Positive market sentiment is bolstered by multiple factors: BitMEX co-founder Arthur Hayes predicts an extended bull market through 2026, while the Winklevoss twins forecast Bitcoin reaching $1 million, calling it 'Gold 2.0'. Institutional confidence is evident with Capital Group's $6 billion Bitcoin bet and Wall Street veterans predicting increased institutional accumulation by year-end. The Fed's planned interest rate cuts could serve as a catalyst for lower yields and potentially higher Bitcoin prices. However, Robert from BTCC cautions that 'fiscal risks remain, and corporate accumulation slowed in August, suggesting some near-term consolidation before further gains.'

Factors Influencing BTC's Price

CryptoAppsy Launches Lightweight Real-Time Tracking App for Cryptocurrency Investors

CryptoAppsy has introduced a seamless solution for tracking cryptocurrency markets, offering real-time price updates and portfolio management without requiring account creation. The app supports thousands of assets, including Bitcoin ($115,653 mentioned in the context) and altcoins, with millisecond latency from global exchanges.

Key features include live price streaming, historical data visualization, and customizable alerts. Investors can monitor arbitrage opportunities and market shifts instantly. The platform's minimalist design prioritizes speed, allowing users to favorite assets for consolidated tracking.

Latin America's Crypto Surge: Regulatory Shifts and 63% Adoption Growth in 2025

Latin America has cemented its position as a crypto adoption hotspot, with transaction volumes surging 63% in 2025—second only to Asia-Pacific's 69% growth. The region's embrace of digital assets reflects a strategic pivot toward financial innovation, driven by volatile local currencies and costly remittance corridors.

Brazil imposed a 17.5% capital gains tax on crypto transactions in June 2025, signaling regulatory maturation. El Salvador softened its groundbreaking Bitcoin mandate, making business acceptance voluntary while maintaining legal tender status. Panama advanced legislation to recognize Bitcoin and stablecoins as legitimate payment instruments.

Chainalysis data reveals Latin American nations dominating global adoption rankings. Stablecoins and Bitcoin serve as dual solutions: hedging instruments against inflation and efficient cross-border settlement rails. This trend underscores blockchain's role in reshaping emerging market finance.

BitMEX Co-Founder Arthur Hayes Predicts Extended Crypto Bull Market Through 2026

Arthur Hayes, co-founder of BitMEX and CIO of Maelstrom, argues that the current cryptocurrency bull cycle has significant runway ahead, potentially extending well into 2026. His bullish thesis hinges on unprecedented global monetary expansion, with central banks and governments far from exhausting their stimulus tools.

U.S. fiscal policy under a potential second Trump administration could unleash substantial spending programs by mid-2026, Hayes suggests. Market participants currently underestimate the tidal wave of liquidity poised to flood risk assets—particularly cryptocurrencies and equities—as policymakers combat geopolitical instability and economic fragmentation.

The erosion of unipolar world order creates fertile ground for competitive currency debasement, according to Hayes. He specifically highlights Europe as a potential flashpoint, where a French sovereign default could trigger accelerated money printing across the bloc. While acknowledging these policies carry long-term risks, Hayes maintains the cycle's speculative peak remains years away.

Bitcoin Bulls Eye Fed Rate Cuts as Catalyst for Lower Yields, but Fiscal Risks Loom

Bitcoin investors are positioning for a potential rally as the Federal Reserve signals impending rate cuts, with a 25-basis-point reduction expected on September 17. The move would lower the benchmark range to 4.00%-4.25%, with futures markets pricing in further easing to sub-3% levels by 2026. Historically, such monetary loosening weakens Treasury yields, creating favorable conditions for risk assets like BTC.

Yet the calculus isn't straightforward. While short-term yields may fall, long-dated Treasuries face upward pressure from ballooning debt issuance. The U.S. government plans significant increases in Treasury bill and note sales to fund extended tax cuts and defense spending—policies projected to add $2.4 trillion to deficits over a decade. This supply glut could anchor long-term yields even as the Fed eases, creating a bifurcated market.

The crypto market's optimism hinges on traditional risk-on behavior resuming across capital markets. But with inflation proving sticky and fiscal concerns mounting, Bitcoin's correlation to macro indicators may deliver surprises rather than the anticipated straightforward bullish narrative.

Fed Plans Interest Rate Cut While Bitcoin Awaits Market Impact

The U.S. Federal Reserve is set to lower interest rates by 25 basis points on September 17, potentially reducing the benchmark rate to 4.00%-4.25%. Analysts project further easing could push rates down to 3% within a year, reshaping market dynamics. Investors are scrutinizing the implications for risk assets, including cryptocurrencies.

Treasury yields face divergent pressures—short-term rates may fall while long-term yields stay elevated due to looming U.S. debt issuance. T. Rowe Price analysts note: "The U.S. Treasury's eventual move to issue more notes and bonds will pressure longer-term yields higher." This bifurcation creates a complex backdrop for Bitcoin and other digital assets.

Market participants anticipate the rate cut could fuel risk appetite, but fiscal concerns may temper the effect. Bitcoin advocates watch for potential capital rotation into alternative assets as traditional yields compress.

Bitcoin Price News: Bulls Eye $120k Next

Bitcoin is testing a critical resistance zone between $116,500 and $117,000, a level that has repeatedly capped gains in recent sessions. The cryptocurrency's ascent follows an ascending triangle breakout earlier this month, which initially targeted this price range.

Market structure remains bullish despite the current consolidation. The 3-day MACD approaches a bullish crossover—a historically reliable momentum indicator. Support levels at $113,000-$113,500 provide a safety net, with stronger footing at $106,700-$107,600 should a deeper correction materialize.

Liquidity heatmaps reveal concentrated liquidation clusters near $116,900, suggesting potential retests of resistance. Below current prices, the $110,000 zone looms as a possible magnet for shorts, though the prevailing uptrend makes this scenario less probable.

A decisive close above $117,000 could open the path toward $120,000, with Bitcoin's all-time high near $124,000 waiting beyond. The market appears poised for either consolidation or another assault on resistance before determining its next directional move.

Corporate Bitcoin Accumulation Slows in August Amid Market Pullback

Bitcoin's institutional adoption engine showed signs of cooling in August as treasury holdings grew by just 47,718 BTC ($5.2 billion) - less than half July's 100,000 BTC accumulation pace. The slowdown coincided with BTC's failure to sustain its $123,000 peak, ending the month 11.5% lower at $109,000.

Public companies nonetheless crossed a symbolic threshold, collectively holding over 1 million BTC for the first time - double late-2024 levels. Healthcare firm KindlyMD executed August's second-largest corporate purchase, acquiring 5,744 BTC worth $679 million.

Notably, $15 billion in announced fundraising by treasury entities like MicroStrategy and Metaplanet failed to translate into immediate market impact. The disconnect between capital commitments and actual buying activity reveals the nuanced relationship between corporate announcements and price momentum.

Wall Street Veteran Predicts Institutional Bitcoin Accumulation by Year-End

Jordi Visser, a seasoned Wall Street analyst, forecasts a significant uptick in Bitcoin allocations by US financial institutions before December 2024. Traditional portfolios are expected to bolster Bitcoin holdings in Q4 as preparation for 2025, with 83% of surveyed institutional investors planning increased crypto exposure next year.

The momentum is already visible: US spot Bitcoin ETFs have attracted $56.79 billion in inflows since January, while public companies now hold $117.03 billion in Bitcoin on their balance sheets. "The supply squeeze is inevitable," notes Visser, referencing pent-up demand from 401k access that could unleash $12 trillion—dwarfing the ETF launch impact.

New Crypto Investors Favor Remittix Over Bitcoin Amid Expectations of Explosive Gains

Bitcoin's price hovers near $116,000, facing resistance at $120,000 as institutional demand and rate cut optimism provide support. Yet, new investors are shifting focus to Remittix, drawn by its potential for higher returns compared to BTC's stability.

While Bitcoin benefits from ETF inflows and macroeconomic tailwinds, technical barriers at $120,000–$125,000 suggest limited near-term upside. Remittix gains attention with its reward mechanisms and utility-driven growth narrative, appealing to those chasing asymmetric opportunities.

The divergence highlights a market split: established assets like BTC anchor portfolios, while emerging tokens like Remittix attract speculative capital. Neither approach excludes the other—bull markets often lift all boats, but at varying speeds.

Winklevoss Twins Forecast Bitcoin's Ascent to $1 Million, Dubbing It 'Gold 2.0'

Tyler and Cameron Winklevoss, early Bitcoin investors turned billionaires, have doubled down on their bullish stance, predicting the cryptocurrency could hit $1 million in the long term. The twins, who first bought BTC at $10 in 2012 using funds from their Facebook settlement, now position Bitcoin as a superior store of value poised to rival gold's market cap.

Their exchange Gemini marks its tenth anniversary this year, cementing their role as crypto pioneers. The Winklevoss thesis aligns with industry heavyweights like former Binance CEO Changpeng Zhao and Blockstream's Adam Back, who see Bitcoin fundamentally reshaping finance.

Capital Group's Bold Bitcoin Bet: A $6 Billion Vote of Confidence

Capital Group, the venerable mutual fund firm with roots in traditional value investing, is making an unexpected pivot into cryptocurrency. Portfolio manager Mark Casey—a 25-year veteran and disciple of Benjamin Graham and Warren Buffett—has spearheaded over $6 billion in Bitcoin-related investments, including a $500 million position in MicroStrategy's BTC holdings.

The move reflects a fundamental thesis: Casey views Bitcoin as digital gold, a non-correlated store of value that will appreciate despite volatility. This conviction has transformed MicroStrategy from a business analytics firm into a de facto Bitcoin proxy for institutional investors.

What makes Capital Group's endorsement remarkable is its contrast with Warren Buffett's famous skepticism toward crypto. The firm's disciplined approach to risk management lends credibility to Bitcoin's maturation as an asset class—even as regulators remain divided.

How High Will BTC Price Go?

Based on current technical indicators and market sentiment, BTC shows strong potential to reach $120,000 in the near term. The price holding above the 20-day moving average at $111,820 demonstrates solid support, while breaking above the upper Bollinger Band at $116,579 could trigger accelerated momentum. Fundamental factors including institutional adoption, favorable regulatory developments in Latin America (63% adoption growth), and potential Fed rate cuts create a constructive environment.

| Price Target | Timeframe | Key Drivers |

|---|---|---|

| $120,000 | Short-term (1-2 months) | Breaking Bollinger upper band, Fed policy |

| $150,000 | Medium-term (6 months) | Institutional accumulation, adoption growth |

| $1,000,000 | Long-term (5+ years) | Global reserve asset status, Gold 2.0 narrative |

Robert from BTCC notes that while short-term pullbacks are possible, the overall trajectory remains bullish with multiple catalysts supporting higher prices.